How to Price: Will HYPE Overtake SOL By End of Year 2026?

21 May 2025This is reposted from X. The original impetus for the thread was:

@ThinkingUSD

Will bet any amount of Money Hyperliquid flips Solana price by end of 2026.

Last edited 7:07 AM · May 20, 2025

Okie dokie let’s do a quick thread on how I would think about pricing this. Caveat: only spent like 15 min or so thinking about this, feel free to debate in the comments. That being said, down to do a small education bet, of let’s say $1m @ThinkingUSD?

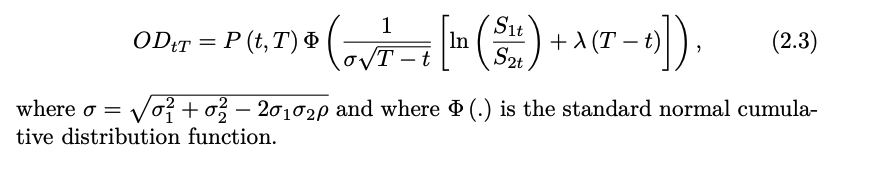

So this type of option is known as a binary “Margrabe option”, which gives the buyer the right, but not the obligation, to exchange the second asset for the first at the time of maturity T.

Our payoff is 1 if the price of HYPE > SOL, and 0 otherwise. Luckily some PhDs worked out all the math decades ago, here’s the formula for the price of the option:

Notice that it depends on the volatility of both assets and the correlation! So putting together a tiny python script to estimate the inputs, I get:

T = 1.616 years

r = .04

HYPE = 26.698

SOL = 166.88

sigma_hype = 1.101

sigma_sol = 0.826

corr = .619

Which spits out a fair value of $0.01298, or about a 1.3% probability HYPE overtakes SOL by end of 2026. This number does feel a bit low to me, so it’s important to note the conditions in which this option could be wildly mispriced.

This option could be mispriced if:

- we have a strong directional view

- we think vols or correlation is mispriced

- we think the price movements have fat tails

Disagreements are what makes markets fun! Lmk your offer @ThinkingUSD