How to price: pump.fun ICO

11 Jul 2025OK quick thread on how I would price the @pumpdotfun ICO using options theory, and why there might be a trading opportunity!

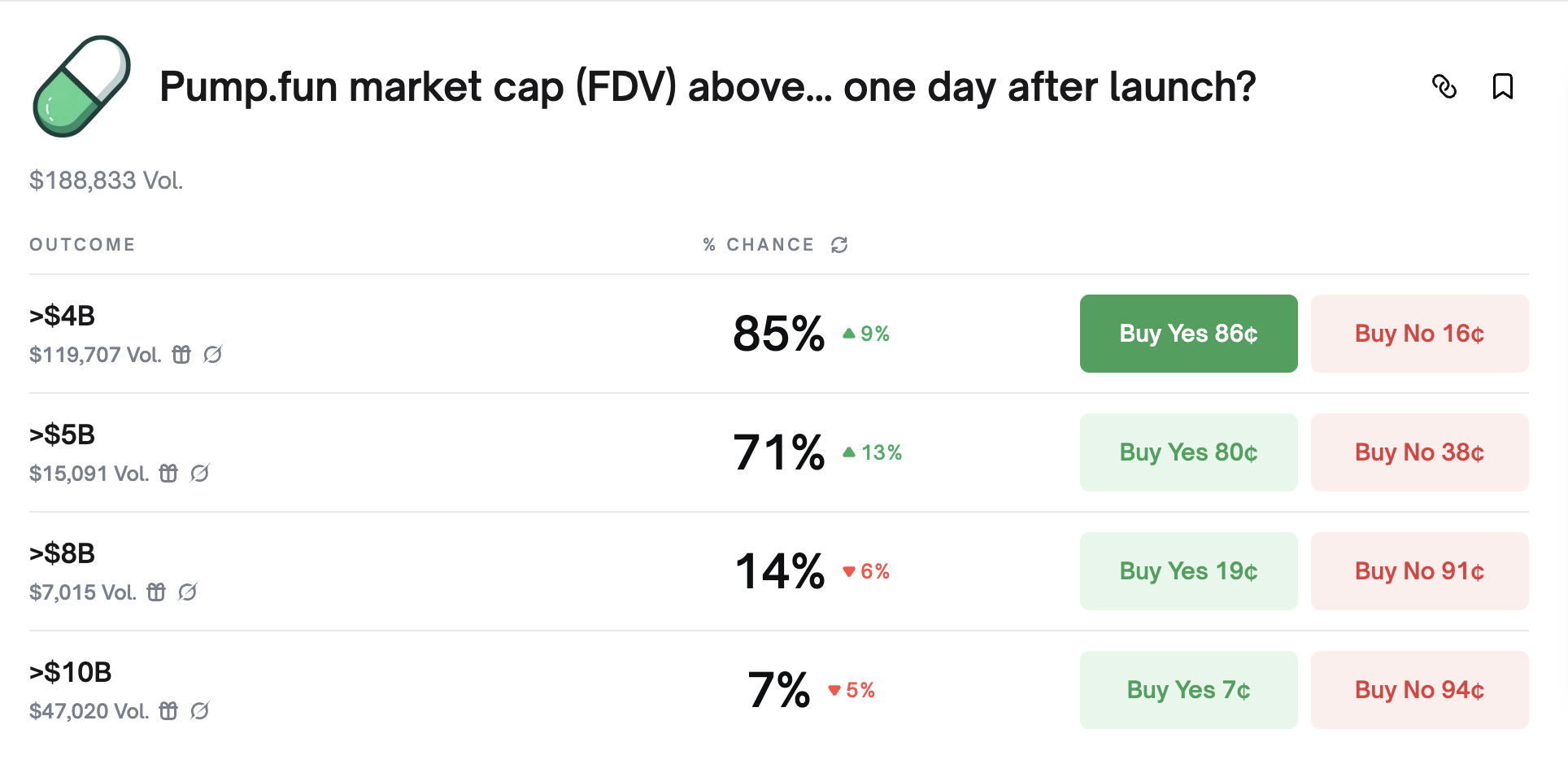

Skimming the market rules and doing a Google search, this seems to be a simple European binary call option with strikes at $4B, $5B, $8B, $10B. It expires in 49 hours and the current underlying price can be obtained from the Hyperliquid pre-market @ $5.353B FDV.

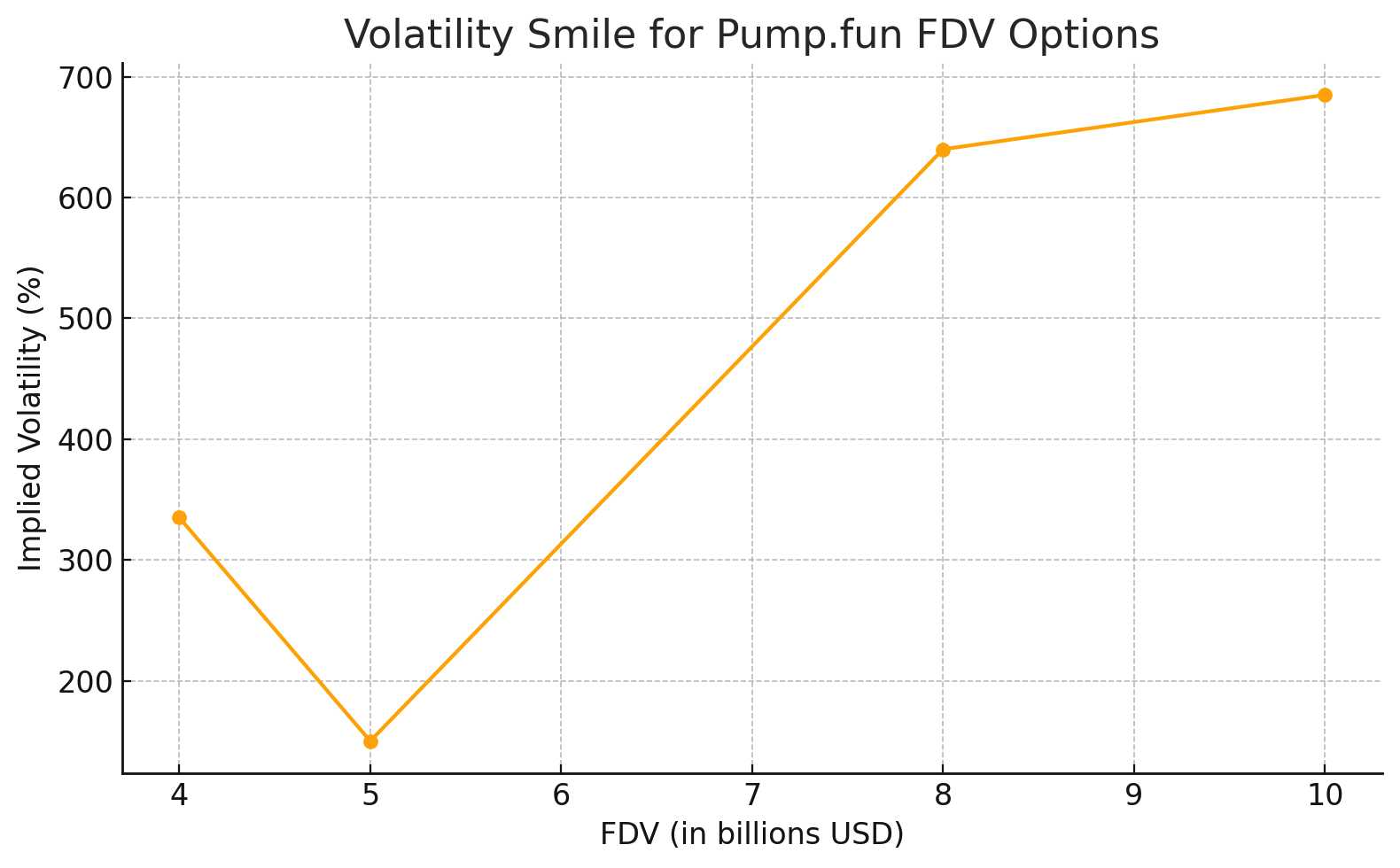

If we use Black-Scholes, we can convert thinking in price-space to thinking in vol-space. Here I’ve plotted the market implied volatilities:

Two things immediately jump out:

-

The implied volatility (IV) at the $5B strike is 150, which appears quite low. This suggests an expected ICO-day price move of only 7.85% in either direction.

-

The ratio of out-of-the-money (OTM) to at-the-money (ATM) volatility is extremely high, with the $8B strike showing an IV of 640%.

My intuition tells me I would want to push up the vol at the 5B strike and push down the vols at the 8B, 10B strikes. For binary options:

- higher IV –> outcomes converge to 50/50

- lower IV –> outcomes converge to 100/0

If spreads permit, this would be buying “No” at all three strikes. Optionally, can compute the deltas and hedge with the pre-market futures on Hyperliquid. Of course there is no serious money here but it’s fun to think about things in options pricing terms.